If a business or not-for-profit is not eligible for JobSaver but is suffering financial hardship, they may be able to apply through the hardship pathway. If your business does not meet all the eligibility criteria, you may be able to apply for JobSaver if you can provide evidence to support the alternative circumstances outlined in the guidelines. For more information, visit JobSaver payment – large tourism, hospitality and recreation businesses. Larger businesses in the hospitality, tourism and recreation industries with a turnover between $250 million and $1 billion may also be eligible for the JobSaver scheme. The JobSaver payment is designed to support businesses and not-for-profit organisations with an aggregated annual turnover between $75,000 and $250 million (inclusive) for the year ended 30 June 2020. If you do not meet all the criteria and supporting evidence requirements

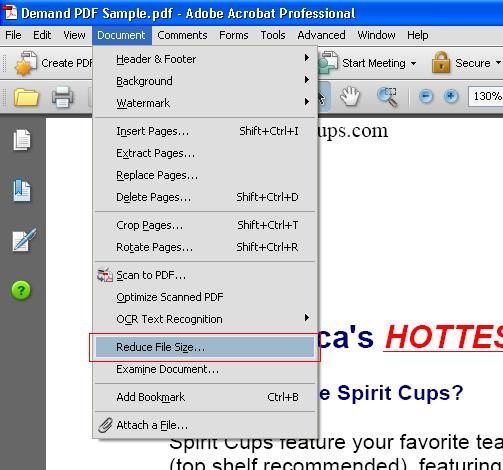

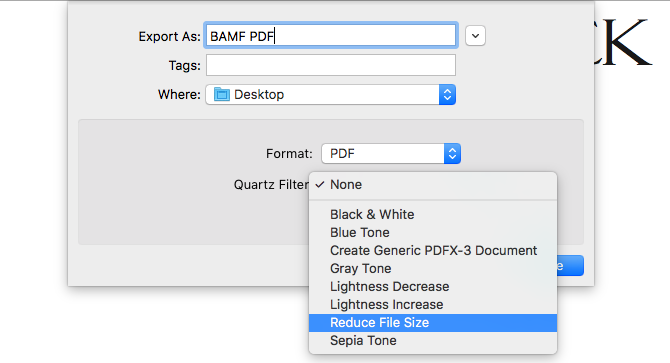

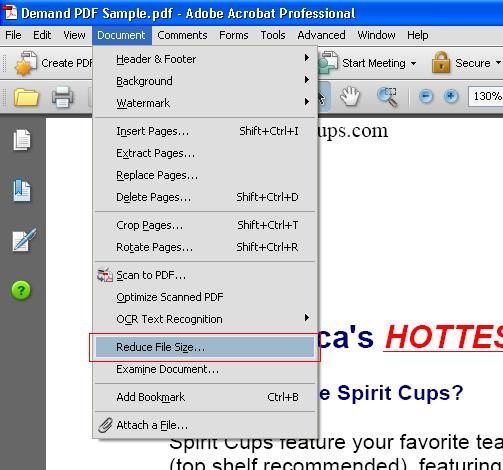

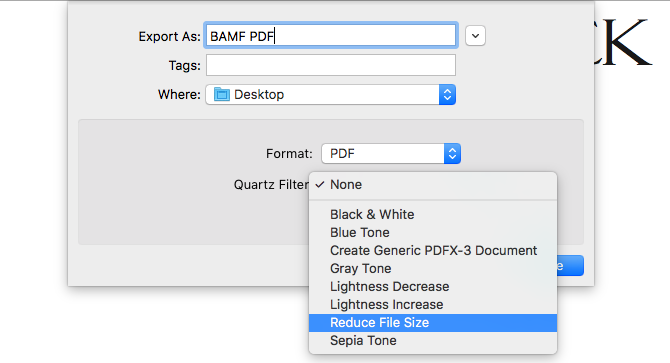

SHRINK PDF SIZE FOR EMAIL MAC FULL

See the full list of ineligible businesses in the guidelines. If passive income is more than 50% but the business is actively providing services that relate to the passive income, call us on 13 77 88.

preventing or relieving the suffering of animals (for example, animal welfare organisations).įor more information, see Attachment E of the JobSaver payment guidelines.Ĭertain entities, such as those earning passive income (rents, interest or dividends) that is more than 50% of the business' income, government agencies, local governments, banks, and universities are not eligible for JobSaver.

advancing social or public welfare (including disability and health social support services), or. have a primary purpose, under Australian Charities and Not-for-profits Commission classifications, of:. NFPs are eligible for this program if they: For more information, visit JobSaver payment – large tourism, hospitality and recreation businesses.Ĭharitable NFP organisations that have experienced a turnover decline of at least 15% and less than 30% as a result of the public health orders may be eligible to apply. Larger businesses in the hospitality, tourism and recreation industries with a turnover between $250 million and $1 billion may be eligible for a larger weekly payment under the extension to the JobSaver scheme. Use of grant fundsĪny business, sole trader or not-for-profit (NFP) organisation with an aggregated annual turnover between $75,000 and $250 million that has been impacted by the Public Health (COVID-19 Temporary Movement and Gathering Restrictions) Order 2021 can apply for this payment if they meet the eligibility criteria. Individuals with multiple businesses with more than one employee may submit one application per ABN. Individuals with more than one non-employing business may only claim payments for one business. What you can claim if you don't have employees or you have multiple businessesįor non-employing businesses, the business receiving payments must be the primary income source (50% or more of total income) for the associated person. That amount should be divided by the number of calendar days reported in the PAYG tax withheld section of the BAS period and multiplied by 7.īusinesses that do not submit a BAS or that submit a BAS without a W1 should refer to the guidelines. Weekly payroll should generally be determined by referring to the calculations underlying the most recent Business Activity Statement (BAS) provided to the Australian Taxation Office (ATO) prior to the 26 June 2021 for the 2020–21 financial year.īusinesses that only operate within New South Wales should first identify the amount reported under item W1 in the relevant BAS and deduct any amounts withheld on behalf of contractors. See our letter of authority template.Ī letter of authority is a legal document that authorises a third party to act on your behalf if they are not listed as an associate on the ABR. Your accountant will ask you to complete a letter of authority and will provide it to Service NSW. If they are not listed as an associate on the Australian Business Register (ABR), your accountant will need to provide a letter of authority from you confirming that they are authorised to act on your business' behalf. Your accountant can apply on behalf of your business. Accountants applying on behalf of businesses If you do not have one, you can create an account when you start your application. A MyServiceNSW Account allows you to claim vouchers and rebates, renew licences and gives you access to your personalised information. You'll need a MyServiceNSW Account to apply.

advancing social or public welfare (including disability and health social support services), or. have a primary purpose, under Australian Charities and Not-for-profits Commission classifications, of:. NFPs are eligible for this program if they: For more information, visit JobSaver payment – large tourism, hospitality and recreation businesses.Ĭharitable NFP organisations that have experienced a turnover decline of at least 15% and less than 30% as a result of the public health orders may be eligible to apply. Larger businesses in the hospitality, tourism and recreation industries with a turnover between $250 million and $1 billion may be eligible for a larger weekly payment under the extension to the JobSaver scheme. Use of grant fundsĪny business, sole trader or not-for-profit (NFP) organisation with an aggregated annual turnover between $75,000 and $250 million that has been impacted by the Public Health (COVID-19 Temporary Movement and Gathering Restrictions) Order 2021 can apply for this payment if they meet the eligibility criteria. Individuals with multiple businesses with more than one employee may submit one application per ABN. Individuals with more than one non-employing business may only claim payments for one business. What you can claim if you don't have employees or you have multiple businessesįor non-employing businesses, the business receiving payments must be the primary income source (50% or more of total income) for the associated person. That amount should be divided by the number of calendar days reported in the PAYG tax withheld section of the BAS period and multiplied by 7.īusinesses that do not submit a BAS or that submit a BAS without a W1 should refer to the guidelines. Weekly payroll should generally be determined by referring to the calculations underlying the most recent Business Activity Statement (BAS) provided to the Australian Taxation Office (ATO) prior to the 26 June 2021 for the 2020–21 financial year.īusinesses that only operate within New South Wales should first identify the amount reported under item W1 in the relevant BAS and deduct any amounts withheld on behalf of contractors. See our letter of authority template.Ī letter of authority is a legal document that authorises a third party to act on your behalf if they are not listed as an associate on the ABR. Your accountant will ask you to complete a letter of authority and will provide it to Service NSW. If they are not listed as an associate on the Australian Business Register (ABR), your accountant will need to provide a letter of authority from you confirming that they are authorised to act on your business' behalf. Your accountant can apply on behalf of your business. Accountants applying on behalf of businesses If you do not have one, you can create an account when you start your application. A MyServiceNSW Account allows you to claim vouchers and rebates, renew licences and gives you access to your personalised information. You'll need a MyServiceNSW Account to apply.

If you need help with your online application, you can contact Service NSW on 13 77 88. Over-the-phone applications are not currently available for the JobSaver payment.

They will close after 11:59pm on 18 October 2021.

0 kommentar(er)

0 kommentar(er)